In an ideal world, your clients would happily pay every invoice promptly, in full, and upon receipt. Sadly, as most freelancers, consultants, and independent contractors can attest, many clients don’t seem to have the same understanding of “upon receipt” or “in full” as the rest of us.

As a result, managing invoices and tracking down late payments can be one of the most frustrating aspects of running your own business. Add invoice disputes to the mix, and you’ve got a recipe for disaster—and even more payment delays.

Having the tools to accurately track your time is crucial, but you also need to know how to communicate and justify your time, costs, and value. This is the key to maintaining transparency, building strong client relationships, and growing your business.

Whether you’re a solopreneur, agency owner, or independent contractor, this article will explore effective strategies for justifying invoices to clients—so you can avoid surprises, maintain transparency, and get paid what you deserve.

How Does Invoice Processing Work?

Before discussing how to justify invoices and billable hours, let’s take a moment to understand invoice processing from the client’s perspective.

When you send an invoice to a client, it goes to their Accounts Payable (AP) department. As the name suggests, this department is responsible for processing and paying invoices from external suppliers, vendors, and contractors the company hires to provide goods or services.

Here’s an overview of the steps involved in invoice processing:

Step 1: Data Capture

When clients receive your invoice, their AP department records the relevant information. If your client uses a digital AP solution, they might capture the data automatically; otherwise, someone in the AP department manually copies the information into their AP system.

Step 2: Authorization

The client shares the details of your invoice with an authorized approver to either approve or reject. The easier your invoice is to read and understand—including the value provided and a breakdown of costs or services rendered—the more likely the client will approve and pay your invoice on time.

Step 3: Payment Processing

Once your invoice is approved, the AP department processes your payment via your agreed-upon method.

Step 4: Filing

The company stores your original invoice details and payment record in their general ledger. AP departments maintain archives of vendor invoices and payments for future reference and potential audits.

Why You Might Need to Justify an Invoice

A client might ask for clarification on your invoice for several reasons. Whatever the situation, it’s important to stand by your work and articulately justify the amount of your invoice.

- Cost surprise. Many invoice disputes are the result of sticker shock. Clients receiving a heftier bill than anticipated are more likely to question the invoice.

- Unclear scope. Sometimes, the client may need help understanding what the invoice covers or it might be a different amount than expected. This type of dispute is often due to vague language on the invoice or a failure to distinguish between multiple services, projects, and additional costs.

- Value discrepancies. In a worst-case scenario, a client might feel that the services rendered are not worth the amount charged on your invoice. If this happens, you may need to re-evaluate the scope of your retainer or service agreement, how your invoice is structured, and/or whether you can improve communication with the client moving forward.

12 Ways to Justify Invoices

Without Damaging Client Relationships

Now that you have a better idea of what invoice processing involves on the client’s end and why you might need to justify an invoice to a client, let’s look at some ways to do so effectively.

1. Set Expectations Upfront

The best way to justify an invoice is to set clear expectations around the costs associated with a project before getting started. Whenever you sign a contract with a new client (or agree to undertake a new type of project for an existing client), it’s important to communicate how and when you will invoice for your time and services.

This is especially important if you’re working remotely and not in the same office or physical place as your clients (which is often the case in our remote working world these days).

By removing uncertainty and addressing potential concerns ahead of time, you can reduce the possibility of misunderstandings that require additional justification.

Also, it’s easiest if you’re using a system or software for customer portal project management if your creative agency or architecture firm is dealing with clients on a regular basis who need to be kept in the loop. If they have access to milestones and deadlines, it’ll be easier to justify invoices.

2. Itemize Your Invoice

Your client should clearly understand what you’ve provided and how much you charge for it, whether you bill by the hour, project, or unit. The easiest way to communicate this information is with an itemized invoice showing the associated charge. Not only does this help the client understand the charges on your bill, but it also minimizes the likelihood of invoice disputes.

Think about it this way: Would you feel more comfortable paying a plumber who appears to pull a number out of thin air or one that provides you with a detailed breakdown of the costs for labor and parts? The latter, of course. You would appreciate a more detailed invoice that provides clarity and helps you understand what you’re paying for—and your clients would prefer the same.

3. Include Clear Descriptions

When justifying the time spent on a client project, you must provide a clear breakdown of the work performed, the number of workers involved, and the value delivered during that time. Include specific descriptions for each line item to avoid uncertainty.

By offering a detailed explanation of the services rendered, you can minimize disputes and easily address any concerns that arise because the information is available on your invoice.

4. Split Projects into Smaller Milestones

Multiple, smaller invoices can be easier to digest for some clients—even if the total amount remains the same. The same client who balks at a one-time charge of $1500 bill might be perfectly content to pay $500 x3 spread out over several weeks.

Not only does this payment structure ease potential cash flow concerns for a small business client, but it can also improve your relationship, build trust, and open up the potential for longer, larger-scale projects.

Your client might view you as more flexible or feel more confident in your commitment to the job than they might if payment were required upfront.

Tip: recurrent invoices or monthly retainer fees are other options you should consider, provided you’ve established a regular work relationship with your client.

5. Break Out Additional Costs

If you’re charging for materials or including a rush fee, don’t assume your client is aware of these individual add-ons. In addition to communicating these costs in advance to the client, make sure they are labeled clearly on your invoice.

Lumping extra costs into a flat fee creates confusion for everyone. However, breaking out one-off costs as a separate line item makes it easy for clients to see what they’re paying for at a glance.

6. Use Time Tracking Software

Accurately tracking the time spent on a client’s project is essential for justifying your invoices. Thanks to time tracking software, it’s easier than ever to record–and prove, if necessary–how much time you spend on various tasks, projects, or clients. Many modern time-tracking tools also simplify sharing project breakdowns with clients, which helps avoid ambiguity regarding invoicing.

7. Use Invoice Processing Tools

An invoice processing tool can significantly streamline justifying invoices to clients. When comparing invoicing software options for your business, look for features that facilitate clear communication, collaboration, and document management, allowing you to share documents and attach screenshots as necessary. This level of transparency helps in building trust and resolving potential disputes efficiently.

8. Provide Supporting Documents for Complex Services

The more complicated your invoice, the greater the potential for confusion, miscommunication, and debate. Accessing detailed reports, progress updates, and metrics that align with their objectives will help your clients recognize and understand the tangible benefits you’ve delivered.

This alignment is especially valuable for professionals offering complex services that cost a higher premium. For example, a financial advisor might use software to create a dashboard that makes it easy for clients to see how their investments are doing.

Similarly, a contractor installing a new kitchen should attach a receipt for the countertop slab so the client knows how much of the invoice you are using to cover those costs.

No matter your industry, clients find data comforting. Attaching supporting documents or providing access to relevant data is one of the easiest, most clear ways to justify billable hours, additional fees, and other business costs.

9. Maintain Open Lines of Communication

Establishing healthy communication with your clients is important for building trust, preventing misunderstandings, and ensuring everyone is happy with the arrangement. It’s always a good idea to let them know you’re happy to answer their questions or talk through anything they may want to discuss.

Your clients appreciate honesty, so proactively address concerns, explain the rationale between certain charges, and update them on your progress. This need for honesty is true whether a client asks you to clarify your invoice or happily pays on time.

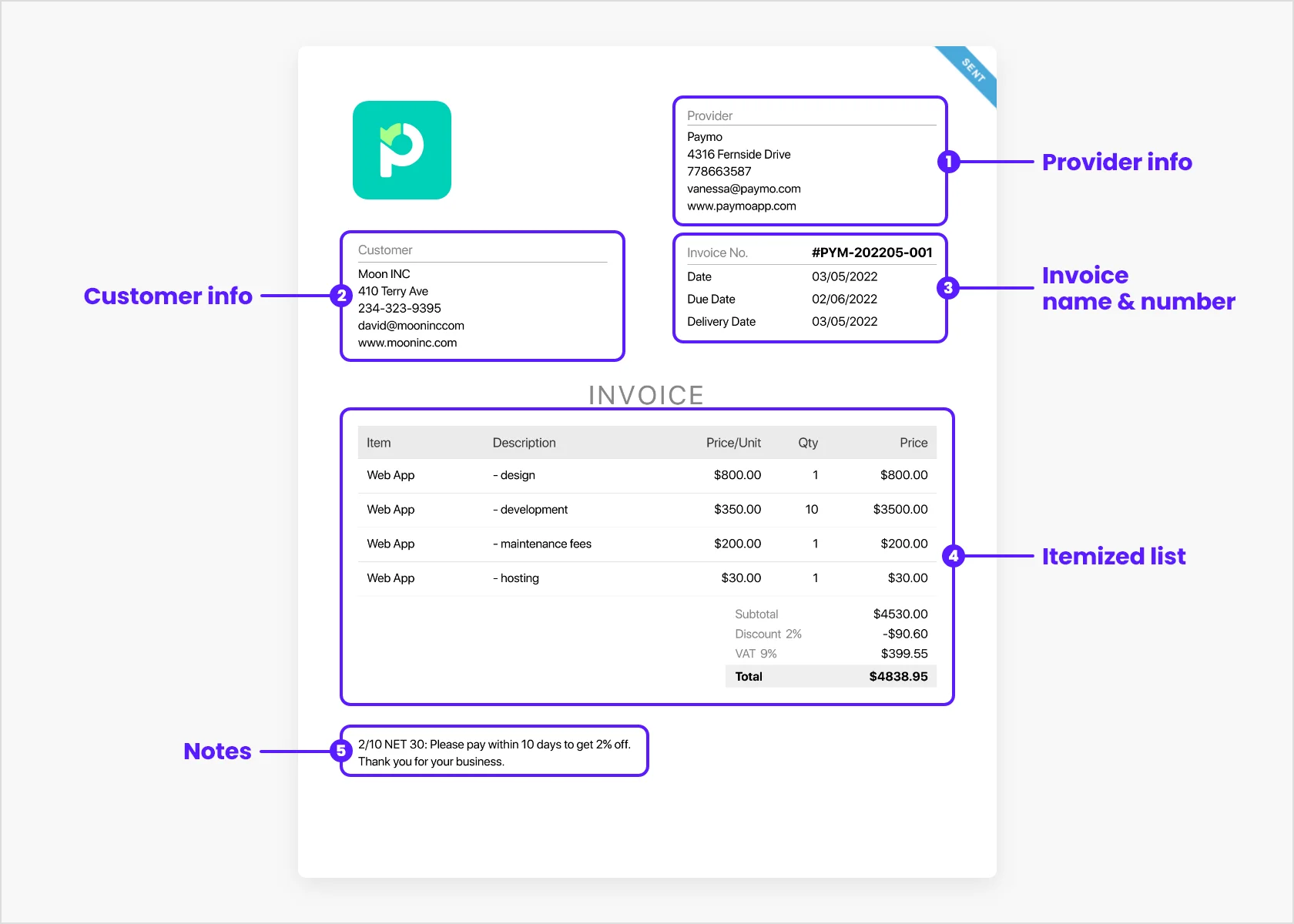

10. Ensure Your Invoice is Complete

To justify your invoice, it needs to be accurate. If information is missing from your invoice, you risk looking unprofessional. After all, if you forget to include your client’s new address or misspell their last name, how can they be sure you didn’t accidentally miscalculate your hours?

A complete, accurate invoice shows clients that you’re a professional and pay attention to details, implying you’re unlikely to make a mistake on the invoice.

Every invoice you send to a client should include the following details:

- Up-to-date contact information (both yours and theirs)

- Project details, including a name or title and service type

- Dates of project or milestone completion

- An itemized breakdown of hours worked, products or units provided, or services rendered

- A subtotal before tax

- Applicable taxes

- The total amount owed

- Payment options

- Payment terms

11. Highlight Any Discounts

If you offer discounts to clients, highlight them on your invoice. Even if you’re throwing in a free bonus item or pro bono work for a non-profit, include it. Indicate the normal cost and a separate line for the discounted amount to show a special rate.

This breakdown prevents assumptions about free or discounted services that could lead to invoice disputes.

12. Keep Your Composure

Not only are invoice disputes one of the most sure-fire ways to interrupt your cash flow, but they can damage your working relationships if you don’t respond appropriately.

If a client disputes something on your invoice, try not to take it personally. Most invoice disputes result from misunderstandings or misaligned expectations. Even if you feel offended, keep your composure. Don’t let a minor invoice dispute escalate into a more serious rift between you and a valued client.

Remember that your client is acting in the best interest of their business. They likely want to resolve this as quickly as you do. So, rather than challenging the client or arguing about the facts, answer their questions truthfully and supply any missing details or documentation as discussed above.

Ideally, you should reply to the client’s email thread so there’s a paper trail documenting your discussion. Address any follow-up questions politely and promptly and offer to walk the client through your invoice on a video call so you can share your screen, establish a human connection, and come to a mutual understanding.

Happy Invoicing!

The ability to justify your invoice to clients is fundamental to maintaining transparency and building strong professional relationships.

By taking advantage of tools and strategies such as invoice processing platforms and time-tracking software, you can generate accurate invoices that reflect the value of your services and build trust with your clients.

Effective communication and a commitment to delivering tangible results will go a long way in solidifying your professional reputation and ensuring success throughout your career.

First published on July 17, 2023.

Emily Bauer

Author

Emily Bauer is a freelance writer who has been helping businesses craft engaging, growth-focused content for the past ten years. She loves working with startups and small businesses in the tech, travel, and marketing space, and especially loves her Corgi, Wilbert.

Alexandra Martin

Editor

Drawing from a background in cognitive linguistics and armed with 10+ years of content writing experience, Alexandra Martin combines her expertise with a newfound interest in productivity and project management. In her spare time, she dabbles in all things creative.